Over the years, I’ve used various tools to help manage my business. I’ve used Quickbooks, MYOB, SAGE, Wave Accounting and ZOHO Books extensively. But I’ve never really been happy.

One reason is the ‘add-ons’. Want to run a payroll? Pay extra. HR? Pay extra. Inventory management? Pay extra. And when you can’t ‘add on’, it’s because that function doesn’t exist but it’s coming ‘real soon now’!

Another is the poor integration and proprietary nature of the tool. Once you’ve started down that path, you become semi-captive and that can lead to a seemingly endless upgrade path. Been there, done that :(

What I’ve always wanted and needed – but struggled to find – is a fully integrated tool that will look after all my accounting needs by integrating CRM, HR, inventory and my ‘books’.

And, not unreasonably, I want my online stores to be fully integrated so that I am not double and even, triple handling data.

Post Contents

- 1 I’ve found the accounting holy grail!

- 2 Picking the right accounting system for your business is the single most important step you’ll have to make in accounting.

- 3 What Is an Accounting System?

- 4 What Are the Different Types of Bookkeeping?

- 5 What Are the Different Accounting Methods?

- 6 Traditional Accounting Systems vs. Online Accounting Systems

- 6.1 10+ Online Accounting System Benefits

- 6.1.1 #1. Automate Journal Entry Creation

- 6.1.2 #2. Create Invoices

- 6.1.3 #3. Send Invoices Instantly

- 6.1.4 #4. Send Late Payment Reminders

- 6.1.5 #5. Save Time and Money With Automation

- 6.1.6 #6. Access Accounting Data Any Time, Anywhere

- 6.1.7 #7. Make Collaboration Easier

- 6.1.8 #8. Improved Accounting Security

- 6.1.9 #9. Improve Accounting & Bookkeeping Accuracy.

- 6.1.10 #10. Real-time Reporting

- 6.1.11 #11. Reduce Paperwork And Improve Sustainability

- 6.1.12 #12. Cost-Efficient Solution

- 6.1 10+ Online Accounting System Benefits

- 7 What’s The Best Online Accounting System in 2020

- 8 Key Takeaways

I’ve found the accounting holy grail!

Here’s the disclaimer… if you keep reading and buy this product, I might make a few dollars. But that’s OK because I really am a ‘true believer’! I’ve hit the mother-lode of business management software!

It includes full featured double-entry accounting, full inventory management including multiple locations, an extensive HR module and a fully functional enterprise standard CRM (Customer Relationship Management) module.

Not enough? How about a fully integrated ‘Shopify-like’ alternative and a development team determined to build the best business management tool available anywhere for SME’s?

And right now, all of this can be had for a LIFETIME price of just $149.00. Period! No renewal cost. No catches. All future upgrades and updates. And, if that isn’t enough, here’s a $10 bonus!

The following post was written by Saurabh, a Deskera team member but the content is, IMHO, as generic and unbiased as it can get.

Read on and you’ll be convinced that Deskera is the all-in-one solution that is going to save any small business owner countless hours of repetitive activity.

Picking the right accounting system for your business is the single most important step you’ll have to make in accounting.

It can help you keep more accurate records of your company’s finances and save you a lot of time and money.

And when the time to file taxes comes, you won’t have to scavenge through piles of invoices and receipts, trying to make sense out of everything.

This way you’ll be able to spend more time on what matters for your business, instead of looking for slips of papers from 10 months ago.

But if you’re new to accounting, you might be wondering, what even is an accounting system?

An accounting system can refer to accounting software or bookkeeping systems (single-entry vs double-entry).

So, how do you know which accounting system is the best one for your business?

Well, in this guide, we’ll explain just that, and more!

Read on to learn about:

- What Is an Accounting System?

- What Are the Different Types of Bookkeeping?

- What Are the Different Accounting Methods?

- Traditional Accounting Systems vs Online Accounting Systems

- What’s the Best Accounting Software in 2020?

What Is an Accounting System?

An accounting system is a system used to track and organize all the financial information for a business.

The main use of accounting systems is to track income, expenses, sales, inventory, taxes, payroll, and compile financial reports.

While there are many ways to differentiate the different types of accounting systems out there, here’s what you need to know.

There are three main accounting systems available out there:

- Manual accounting systems

- Automated accounting systems

- ERP software.

#1. Manual Accounting Systems

This is the most traditional type of accounting system. For this, you can use a pen and paper, or an Excel/G Sheets spreadsheet to organize your financial data.

A common way to organize the different accounts and financial reports is by using separate spreadsheets. While you can automate certain parts of the process with formulas and spreadsheets, you’ll still have to track and input every transaction manually and ensure that everything balances out in the end.

As a given, doing accounting for your business the manual way can become increasingly time-consuming as your business starts to scale.

That’s why most business owners nowadays use some kind of automated accounting system.

#2. Automated Cloud Accounting Systems

The most common example of an automated accounting system is online (or cloud-based) accounting software.

Online accounting software is a system that helps automate parts of the accounting cycle, such as recording journal entries.

Instead of having to manually create a journal entry for every transaction that occurs, the software allows you to integrate your bank directly so that whenever you make a payment, a journal entry is created automatically and it is mapped to the correct accounts.

With online accounting software, you can also automate things like calculating sales tax, generating financial reports, creating and sending invoices, sending payment reminders for delayed payments, and more.

Asides from saving your small business a ton of time, it will also increase your accounting accuracy.

3. ERP (Enterprise Resource Planning) Software

One of the most common examples of ERP software is SAP. This used to be the standard for accounting software before cloud accounting software came into the picture. You can use it to manage inventory, track expenses, and more.

The issue with it, however, is that it is extremely expensive. This type of software solution usually can cost more than $10,000 monthly depending on your needs.

So as you might have guessed, it has historically been used only by large companies or enterprises.

What Are the Different Types of Bookkeeping?

When doing accounting for your business, it’s essential that you also choose a bookkeeping system.

There are two types of bookkeeping systems:

- Single-entry bookkeeping.

- Double-entry bookkeeping.

Here is what each one of them means for you.

#1. Single-Entry Bookkeeping System

Single-entry bookkeeping is the simpler bookkeeping system. It’s also the only type of bookkeeping that can be done with a pen & paper.

When following the single-entry bookkeeping system, you only need to create one entry for each transaction that occurs.

What makes this accounting system simple is the fact that there is no need to keep track of different journals. All of these transactions are recorded in a single journal called the cash book.

Typically, a journal entry under the single-entry bookkeeping system would be composed of the following elements:

- Transaction date – The date in which the transaction occurs.

- Description of the transaction.

- Transaction value – This can be positive or negative depending on whether the money is flowing in or out. One way to improve this is by using two separate columns, one for tracking income and one for expenses.

- Balance – This is a running tally of the cash at hand.

- Reference – You can use this column as a reference to the invoice for which the transaction was made.

All in all, the main transactions you’ll need to track when doing single-entry bookkeeping are:

- Tax-deductible expenses

- Taxable income

- Cash transactions

So you might be asking yourself, what business can use single-entry bookkeeping?

You should go for single entry bookkeeping, if:

- Your business is quite small

- You can’t afford an accountant

- You don’t deal with inventory

- All your transactions are dealt with in cash, and there are no credit sales or purchases done.

That is because the single-entry accounting system is a lot more simple and straightforward than the double-entry one.

Once things start to scale, though, you’d want to switch to double-entry because [reasons]

#2. Double-Entry Bookkeeping System

The main thing that distinguishes the double-entry bookkeeping system from the single-entry one is that for each transaction two entries are created instead of one.

So whenever you make a business transaction, two accounts are changed – one is debited and the other one is credited.

If this sounds a bit complicated, then just think about any transaction you’ve ever made. You buy a product or a service in exchange for money. When this happens, the cash account decreases, and the inventory account (for example) increases.

This is where the name double-entry bookkeeping derives from.

In order to fully understand double-entry bookkeeping, you need to learn the difference between debit and credit.

In brief: debit is money that flows into an account, whereas credit is money that flows out of an account.

Now since this can be confusing at first, we made a cheat sheet to make this easier for you:

| Types of accounts | Debit (always on the left) | Credit (always on the right) |

|---|---|---|

| Assets are the resources of a business. They include accounts receivable, equipment, cash, etc. | Increase | Decrease |

| Expenses are the cost of the consumed assets. They include rent, interest expense, etc. | Increase | Decrease |

| The owner’s equity represents the owner’s investments in a company. | Decrease | Increase |

| Liabilities are claims against assets. These include accounts payable, wages payable, notes payable, etc. | Decrease | Increase |

| Revenue is cash received from business activities such as sales, dividends, services, etc. | Decrease | Increase |

The double-entry bookkeeping system is the most used one out there. While it does seem a bit complicated at first, you’ll see that it’s very logical once you delve a bit deeper into it.

That’s because double-entry bookkeeping clearly reflects the double-sided nature of all financial transactions. And additionally, it provides a more organized and accurate methodology for recording and tracking financial information.

What Are the Different Accounting Methods?

There are two main types of accounting methods that businesses use – cash-based accounting and accrual-based accounting.

The difference between these two accounting methods is the following.

- In the accrual accounting method the revenue is posted when the service or product is sold and not when money is received. And the same goes for expenses, they are posted whenever they are incurred, and not when paid.

- In the cash accounting method the revenue is posted when the money is received, and expenses are posted whenever they are paid.

Which one of the two accounting methods should your business use?

Well, for starters, cash-based accounting is a lot simpler, and thus preferred by very small businesses. However, your business must be carrying out all transactions in cash.

Therefore, if your business makes sales or purchases on credit, you’ll be forced to use accrual based accounting.

Additionally, most tax authorities will require you to use accrual-based accounting. In the US, for example, any business that makes over $5 million in yearly revenue is required by law to use the accrual accounting method.

The only issue with doing accrual accounting is that it can become quite complex depending on the nature of your business.

That’s why most businesses nowadays use accounting software to automate some steps of the accounting cycle.

Online accounting software can help you with things like creating and sending invoices, sending late payment reminders, calculating sales taxes, automatic journal entry creation, and compiling any kind of accounting report for your business.

Read on to learn how accounting software can help you do your small business accounting.

Traditional Accounting Systems vs. Online Accounting Systems

In 2020, most businesses use some kind of automated accounting system to do accounting for their business.

Only a few, very small companies actually do accounting manually.

So what kind of features and benefits should you expect to get when looking for an online accounting system for your business?

10+ Online Accounting System Benefits

#1. Automate Journal Entry Creation

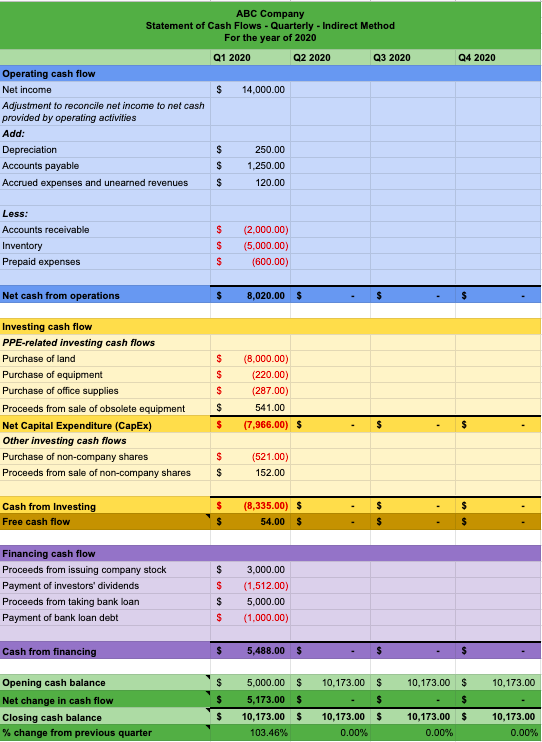

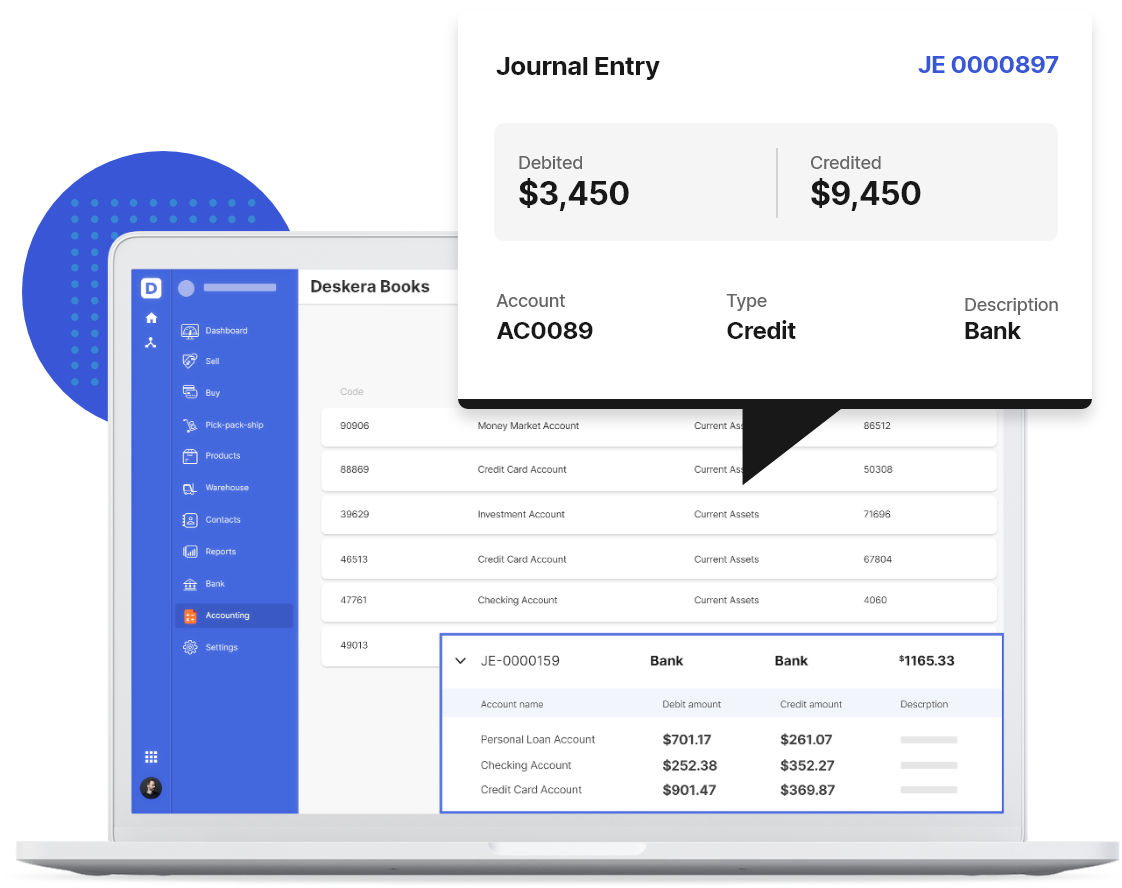

The most common accounting process you can automate using online accounting software is journal entry creation. Most online accounting systems allow you to integrate your bank accounts directly. This way, whenever you receive a payment or make a business expense, a journal entry is automatically generated.

The entry is automatically mapped to the respective accounts which are then debited and credited.

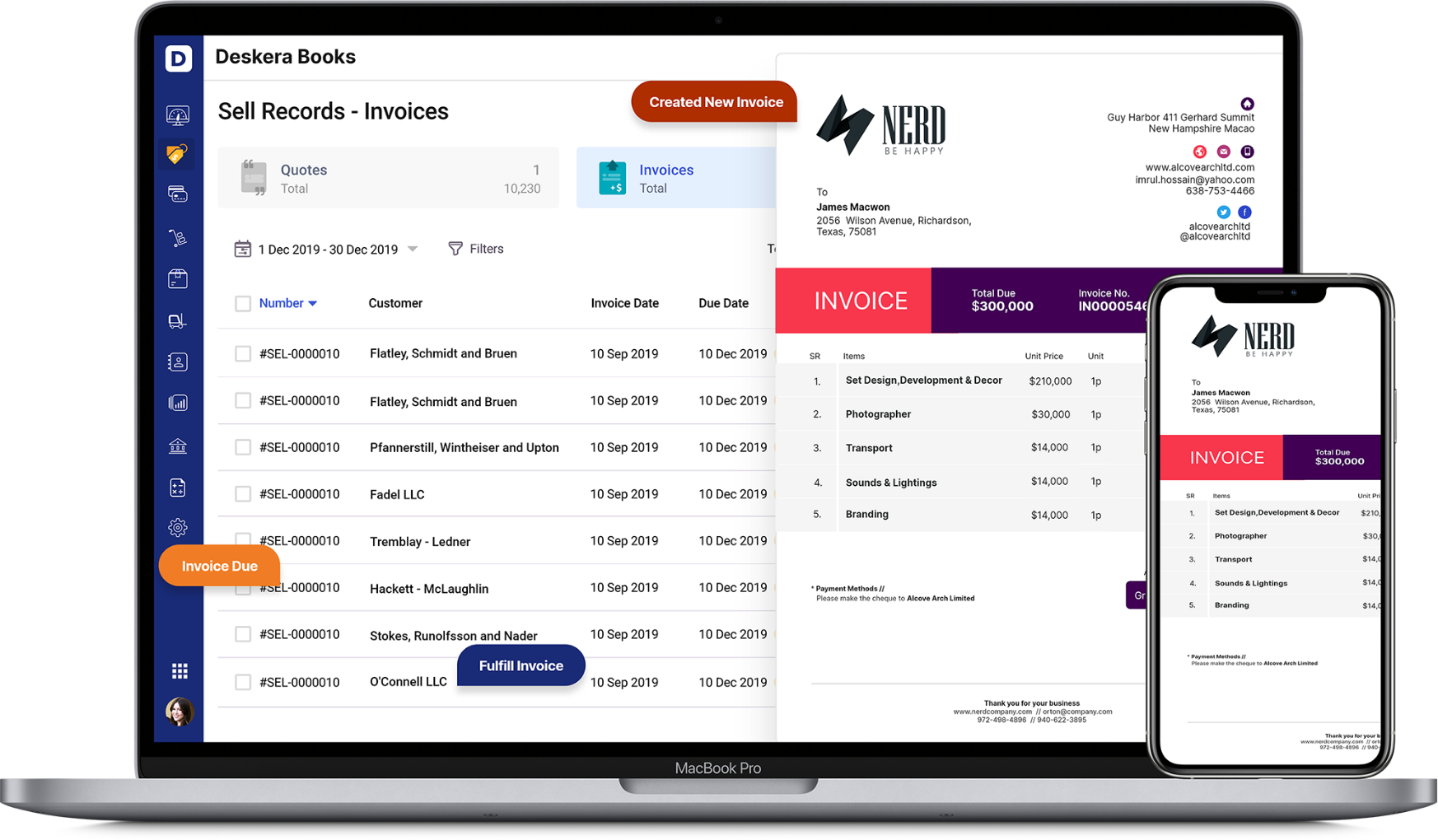

#2. Create Invoices

Creating invoices is one of those menial tasks that every business has to carry out. Before, people used to make invoices using Excel, Word, or even by hand. And the result was usually a badly formatted invoice, which would probably take several minutes to create.

With cloud-based accounting software, you can create a beautiful invoice using one of the premade professional templates in a matter of seconds.

Then all you have to do is re-use the same invoice format for all of your invoices. You can literally duplicate invoices with a single click, and simply edit the information within.

#3. Send Invoices Instantly

Once you have created your professional looking invoice, you can send it directly using your accounting software. All you have to do is insert your client’s email and click send!

#4. Send Late Payment Reminders

Receiving late payments is any business owner’s nightmare. Luckily, online accounting software can help with this as well. If your customers or clients are delaying your payments, you can send them a reminder with a couple of clicks.

#5. Save Time and Money With Automation

There are many steps of the accounting cycle that you can automate using accounting software. For starters, you can automate journal entry creation, as we explained before.

You can also automate things like financial reporting (e.g: create a report every X day of the month) or even setting up automated vendor payments.

#6. Access Accounting Data Any Time, Anywhere

The number one advantage that cloud-based accounting software has over any traditional accounting system is that it allows you to access your data at any time you want, from whichever device you want (as long as the device has internet access).

Online accounting software can be accessed from your computer, laptop, tablet, and mobile phone. This means you can create and send invoices on the go, or download financial statements and reports whenever you need them.

#7. Make Collaboration Easier

Since online accounting software can be accessed from any device that has an internet connection and a browser, making collaboration easier. Multiple users can work on the same set of accounting data in real-time without getting in each other’s way.

You can also give different users different access levels to different parts of the accounting system. This way you can tailor permissions to the set of activities that a user needs to carry out.

#8. Improved Accounting Security

With cloud-based accounting software, all of your accounting data is safely secured on the cloud. It’s covered under layers of encryption algorithms, making it safer than keeping it on the office shelf.

Even when using desktop based accounting software, accounting data had to continuously be backed up. After all, the data was stored on a hard drive. And as you probably already know, hard drives are quite delicate: can get destroyed, wiped, or simply get corrupted and unusable.

With cloud-based accounting, you’ll never have to worry about backing up your data – the system will do it for you.

#9. Improve Accounting & Bookkeeping Accuracy.

With online accounting software, you can say goodbye to most of the typical accounting errors. When entries don’t balance, for example, the system will notify you and highlight the possible error.

All in all, using online accounting software will ensure that your accounting records are properly and accurately organized. As a result, your financial reports’ accuracy will also increase, and your team will have an easier time making decisions.

#10. Real-time Reporting

Want to track everything in real time? All you have to do is integrate your cloud-based accounting software with your business bank accounts and you’ll be able to track expenses, sales, and inventory in real-time. No more wasting your time waiting for something as simple as bank reconciliation.

#11. Reduce Paperwork And Improve Sustainability

First off, dealing with paperwork is time-consuming. With cloud-based accounting software all the financial data including entries, financial statements, and reports are online. Everything is created and stored under layers of encryption in the cloud.

No more paperwork!

You can also create and send invoices directly from the software to your clients, reducing the time and money wasted on printing and posting the invoices, while also speeding up the process of getting paid.

#12. Cost-Efficient Solution

Online accounting software typically costs between $9 and $50 a month per user. And if you find the right accounting software, they’ll only charge you for power users and also allow you to invite as many free guests as you want.

Considering the time you save by using accounting software, accounting software basically pays for itself.

And when compared to ERP software, which can cost over $10,000 a month, using cloud-based accounting software is undoubtedly the best and most affordable way to go for a small or medium sized business.

What’s The Best Online Accounting System in 2020

The best online accounting system for a business should provide all of the features and benefits that we just listed in the previous section.

We went through and compared every online accounting software there is out there. We ranked them based on factors like price, integrations, automation features, reporting features and so on.

But since it would be impossible to visually represent a comparison of all the 100+ accounting software, we compiled a table of the top three most used accounting software. Namely, Deskera Books, Quickbooks, and Freshbooks.

| Features | Deskera | Quickbooks Online | Freshbooks |

|---|---|---|---|

| Invoice and Bills | Yes | Yes | Yes |

| Multi Currency Accounting | Yes | Yes | Yes |

| Inventory | Yes | Yes | No |

| Pick Pack Ship | Yes | No | No |

| CRM | Yes | No | No |

| Dropship | Yes | No | No |

| Backorder | Yes | No | No |

| Bank Recon | Yes | Yes | Yes |

| Payroll, Leave & Expense | Yes | No | No |

As you might have expected, none of the traditional ERP software made it to the top of the list. Their pricing is unreasonable for most businesses, making cloud-based accounting software the most obvious choice.

At the top of our list comes Deskera.

Why Is Deskera the Best Online Accounting system?

- Access your accounting data from anywhere. Deskera is intuitive,easy-to-use cloud-based accounting software which you can access from any device that has an internet connection and a web browser.This means you can access your accounting data from your PC, laptop or mobile phone.

- Business bank account integration. Deskera allows you to integrate your business bank accounts with the software directly in order to track payments and expenses automatically, making bank reconciliation as easy as it can get.

- Create invoices with a single click. You can create professional invoices using one of the 20+ premade templates. You can then customize it by adding your business information, logo, and brand colors, and then send it to your client with just the click of a button.

- Late payment reminders. And if the clients delay payments? Sending a reminder will take you less than 10 seconds. This way, you’ll make sure to get paid on time, every time.

- Accounting process automation. Deskera will also save you on average over 200 hours a month by automating processes such as journal entry creation. When creating an invoice for example, the software will automatically create the journal entry and map it to the relevant accounts without you having to lift a finger.

- Inventory & warehouse management. You can also track and manage inventory to ensure your warehouse/s are always fully stocked.

- Affordable for business of any size. And to top it all off, Deskera comes at a very affordable price – starting at only just $9 per month! Want to give it a try? Get your free trial now! No credit card required.

Key Takeaways

And that’s a wrap! Here’s what we covered in this guide:

- It is important to choose the right accounting system for your business because it can save you a lot of time, money, and headaches.

- An accounting system is a system used to track and organize all the financial information for a business such as income, expenses, sales, inventory, taxes, payroll, and compile financial reports.

- Accounting systems can be either manual accounting systems (pen & paper or spreadsheets), automated cloud accounting systems (online accounting software), or ERP software.

- The different types of accounting systems are single-entry bookkeeping and double-entry bookkeeping

- The different accounting methods are cash-based accounting and accrual-based accounting

Being able to know where your business stands at any point in time is critical to survival in today’s business environment. Profit is important but cash-flow can be the difference between growth and demise.

Your business management systems and software must be capable of ‘keeping you in the loop’ as you grow but it has to be able to do that a cost that you can afford. Here’s the link to that deal again… Deskera $149 lifetime offer!